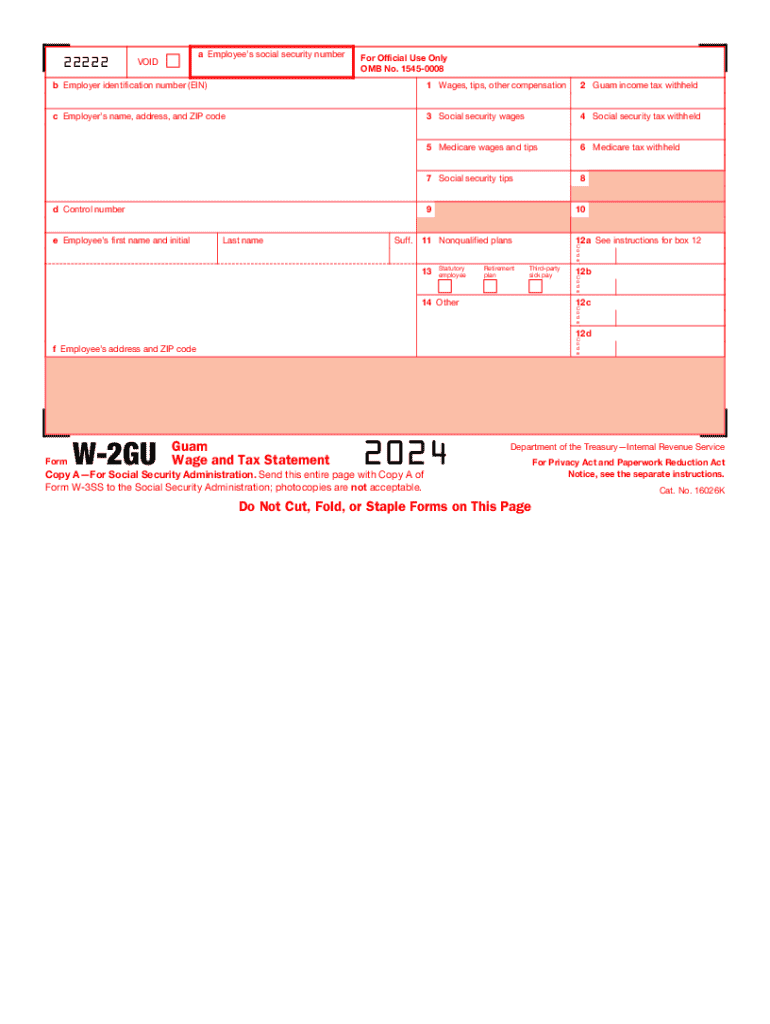

Who needs the IRS W-2GU form?

W-2GU is the Internal Revenue Service Form, which is officially called Guam Wage and Tax Statement. An employer doing business in the territory of Guam must file this statement in duplicate and send one to an employee and the other to the Internal Revenue Service. It must report annual wages and taxes withheld for the previous year. It must be taken into consideration. There is no need to issue form W-2GU to contract workers, as they are required to submit Form 1099-MISC for reporting their income earned.

What is W-2GU Form for?

By means of this form, an employer reports the amount of wages paid to their employees and taxes that are withheld to be paid to the government. An employee in their turn needs W-2GU in order to prepare their annual income tax return (typically, filed on Form 1040 or equivalent).

Is Guam Wage and Tax Statement Form accompanied by other forms?

Typically, employers file form W-2GU together with form W-3 with the Social Security Administration and the SSA that reports the amounts earned and withheld to the IRS.

As for employees receiving the W-2GU, they need the information from the statement while filing their annual income tax reports.

When is W-2GU Form due?

The employer is required to deliver three copies of the W-2GU to their employees by the January 31st so that they have enough to check and collect all the documents necessary to file form 1040 (or its equivalent) by the Tax Day, which is April 18 in 2017.

How do I fill out the Guam Wage and Tax Statement Form?

The completed Statement form must contain: EIN, employer’s name, address, control number, employee’s name, their address, enumeration of wages, tips and taxes withheld, etc.

Where do I send the completed W-2GU Form?

The employee must send three copies of the W-2 to each employee; one copy must be delivered to the SSA and one retained for their records. The detailed instructions can be also checked in the content of the form itself.